I will import your client list for free even during your trial period. All you have to do is send me a CSV file or spreadsheet file containing your client’s contact data.

Client’s are stored either as individuals or businesses in Huskey Practice Manager. Here are two sample CSV files that you can take a look at when preparing your client list for import. Your file does not have to look exactly like this. It is just to show you all the available fields.

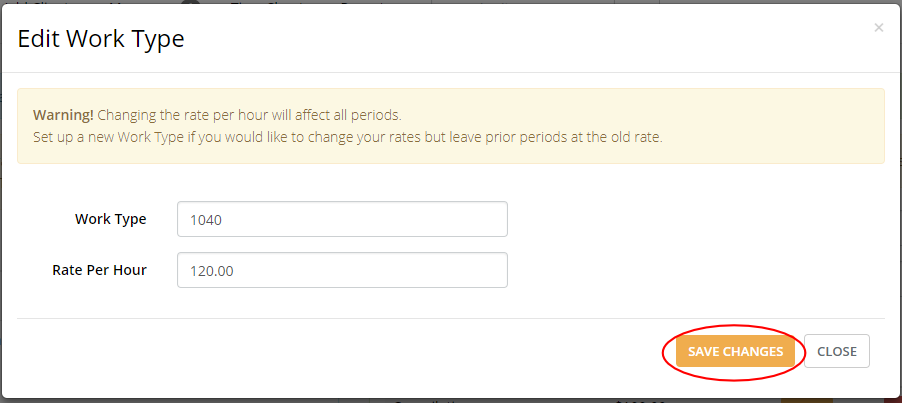

You can include a return type with each client. Here are the available return types:

Individuals:

1040

Businesses:

1120s

1120

1065

1041

1040 Schedule C

1040 Schedule E

1040 Schedule F

990

990-EZ

990-N

709

706

5227

When you are ready to send your client list, send an email to jason@huskeypracticemanager.com. I will send back a secure link for you to drop your files in.

Once I have your file it will usually be imported the same day.

As always, call me at 573-225-7188 or email with any questions.