The to do list is a great place to put jobs that do not recur. Watch the video below to learn more.

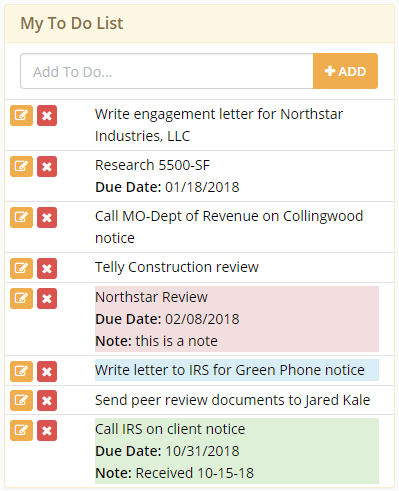

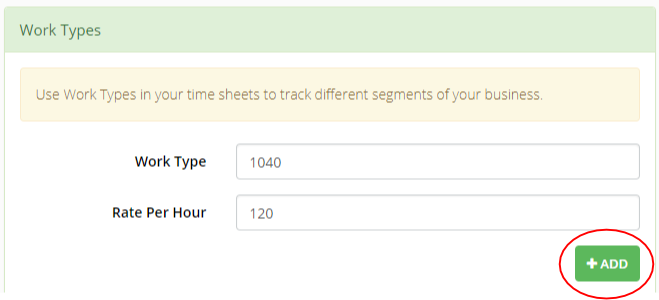

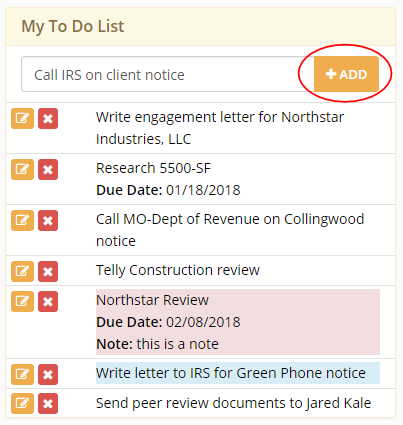

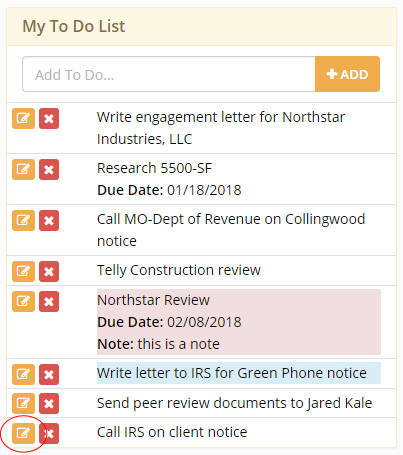

To add an item to your to do list just type a description in the box and click ADD.

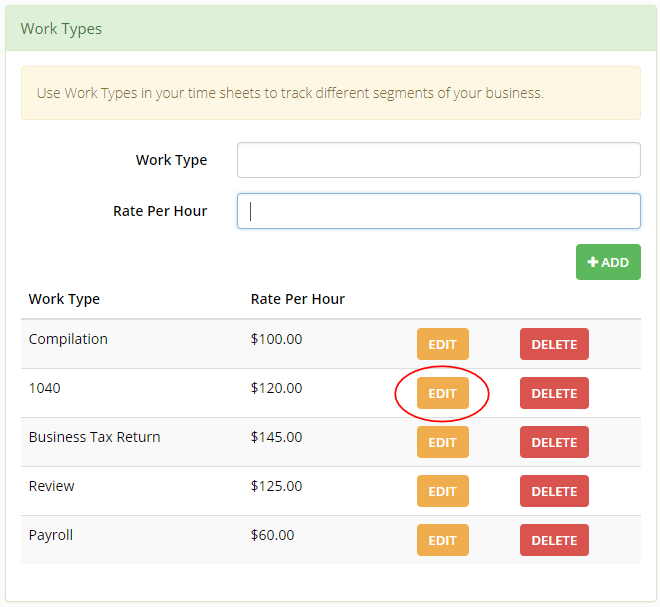

Click the red X button to remove an item from the list or click the orange button to edit the item. Let’s edit the item we just added.

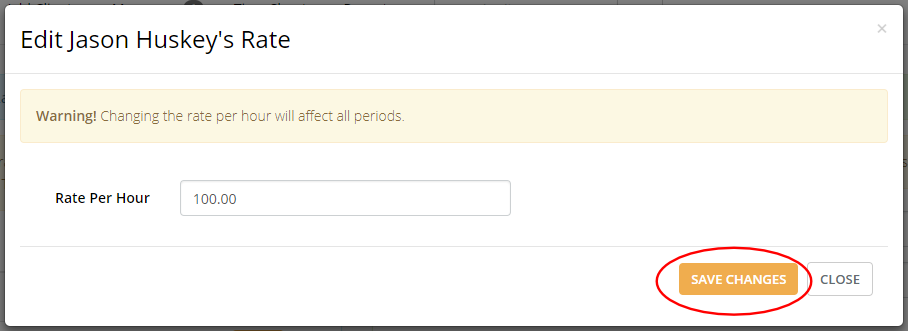

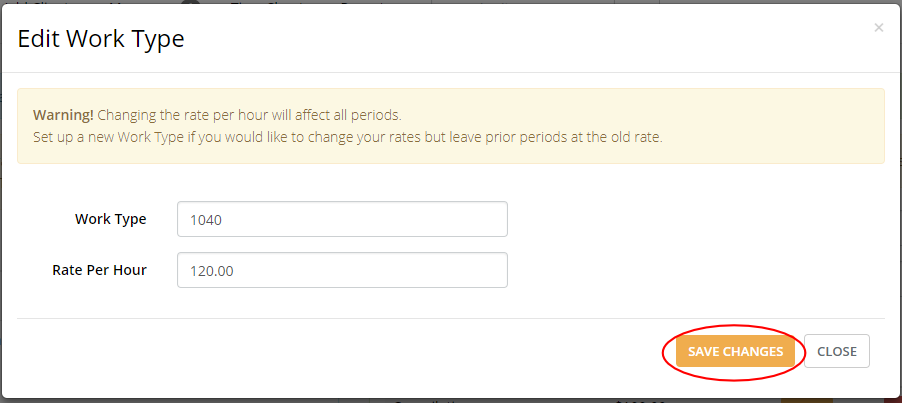

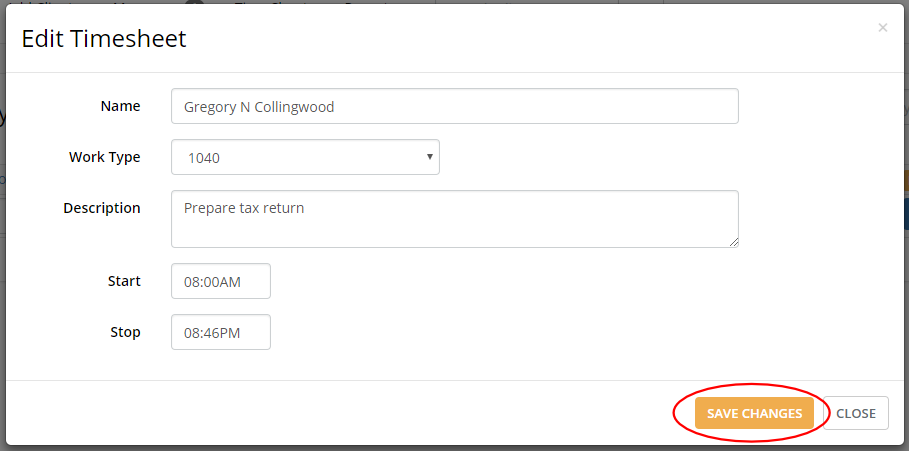

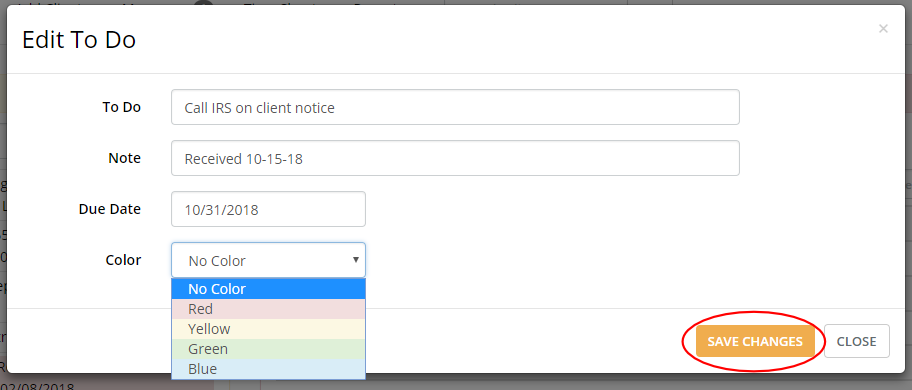

In the editing pop-up window you can add a note or a due date. You can also add a color to signify how important the job is. Remember to click SAVE CHANGES.

Your updated to do item will now show your changes.